Aussies who have not submitted a tax return have just four days to get their finances in order before they start racking up late lodgement fees.

For taxpayers submitting their own returns, the official last lodgement date is October 31, 2020.

Because this falls on a Saturday this year, the Australian Tax Office allows lodgements to occur until the next business day – effectively making the deadline Monday November 2.

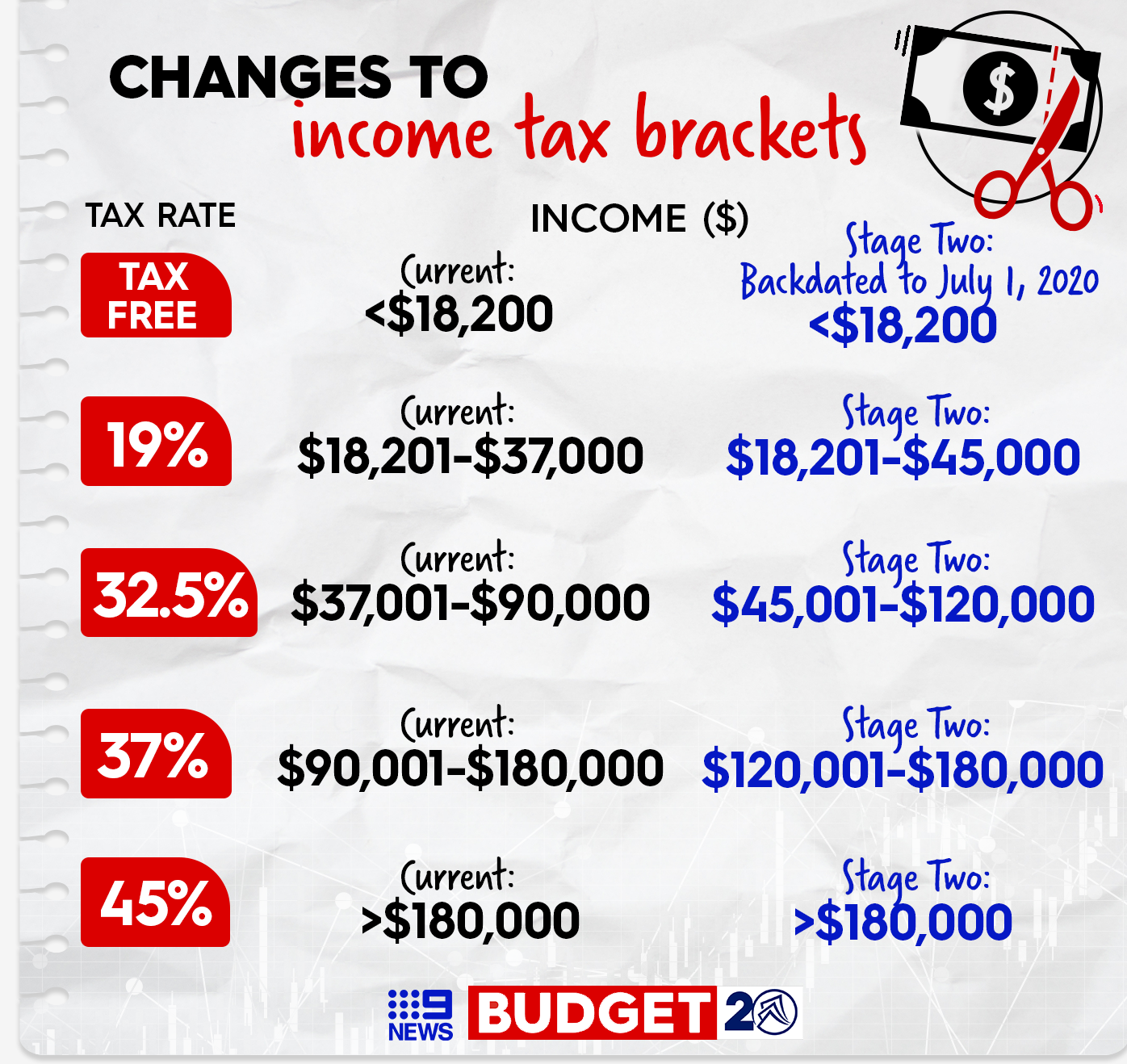

READ MORE: What to do with your tax cuts: spend or save?

Mark Chapman, Director of Tax Communications at H&R Block, told 9News.com.au that Aussies who haven't lodged a return yet still have options.

"There's two different scenarios. The first is if you are a tax agent's client by the 31st of October the October deadline doesn't mean anything," Mr Chapman explains.

"The second is, if you were intending to lodge yourself and you haven't registered with a tax agent and you get beyond that October 31 deadline, unfortunately you're in a position to receive a penalty."

READ MORE: Winners and losers from the budget

As Mr Chapman explains, tax agents have different deadlines to taxpayers lodging their returns themselves – but they must have the client "on the books" prior to October 31.

"If you want to lodge yourself, make sure you do it soon," Mr Chapman explains.

"If there's some reason you don't want to do that – maybe you don't have the time, can't be bothered, it's all too much hassle – make sure you go to a tax agent by the 31st of October and get your name on their client list.

"That can be as simple as phoning up, proving you are who you say you are, get yourself on their list and then essentially that October deadline does not apply to you."

READ MORE: Some of history's most notorious tax dodgers - who got caught

Fail to lodge your own return or become a client of a registered tax agent by the due date, and the penalties can accumulate over time.

"You become immediately liable for a $222 penalty if you do not lodge by November 2 in this instance. That $222 penalty increases by a further $222 for every 28 days you continue to be late," Mr Chapman said.

"It can potentially go all the way up to five times $220 or $1110. That's the maximum penalty you can get if you continue to not lodge your tax."

If the entire idea of filing your return sounds overwhelming – or its your first time – using a tax agent starts with a simple phone call.

READ MORE: Scammers pretending to be police and ATO prompts fresh warning

"If you're not entirely sure what you might need to take in maybe just give the tax agent a ring beforehand, most tax agents have a checklist available which they can send you which will list all of the things you'd need to prepare your tax return properly," Mr Chapman advises.

"If you've got a fairly straightforward tax return, you're probably looking in the ballpark of $160 to have your tax done by a tax agent.

"That's tax deductible too, and generally speaking most tax agents will be able to find you some extra deductions that you didn't know you could claim so in a sense it can pay for itself in the long run – not to mention the fact it's a lot less stressful and time consuming to get someone else to do it."

You can get up-to-date information from the Federal Government's Coronavirus Australia app, available on the App Store, Google Play and the Government's WhatsApp channel.

Beyond Blue's Coronavirus Mental Wellbeing Support Service is a 24/7 service free of charge to all Australians. Visit the site here or call 1800512348

For coronavirus breaking news alerts and livestreams straight to your smartphone sign up to the 9News app and set notifications to on at the App Store or Google Play.

from 9News https://ift.tt/3lYXJnc

via IFTTT

0 Comments