From accessing another $10,000 of superannuation to boosting the minimum wage, Australians can expect a raft of new changes with the beginning of another financial year.

As the clock ticked over to July 1 overnight, a number of sweeping financial measures and laws took effect.

From snapping up a cheap home loan to earning more in your weekly pay packet, here's what you can expect from the first day of the new financial year:

READ MORE: The top five mistakes people make on their tax returns

'OPEN BANKING' BEGINS, MAKING IT EASIER TO SWITCH

It might sound fairly insignificant, but today one of the biggest financial overhauls of our time has taken effect, known as "open banking".

Under the new regulations, Australians can instruct their bank to share data from their credit and debit cards, and savings and transaction accounts.

It sounds like a privacy nightmare – but in reality it will make it far easier for customers to cross-shop financial products and get the best deal.

For example, you could theoretically direct your bank to share your transaction details with an open-source budgeting app to help you save. Previously, you'd have to rely on whatever product your bank could offer in-house.

10,000 MORE SPOTS FOR CHEAP FIRST-TIME HOME LOANS

As of today, the Federal Government has opened up 10,000 more spots for first home buyers looking to crack the Australian property market with a minimal deposit.

Known as the First Home Buyer Deposit Scheme, the benefit allows first-time buyers to put down just 5 per cent deposit for a property with the government acting as guarantor for the remaining 15 per cent.

Buyers still have to pay the remaining 15 per cent, as they are technically borrowing 95 percent of the property's valuation from a lender.

As of January 1 this year, 10,000 applications – for couples and singles alike – were made available, with a second 10,000 made available today for the 20/21 financial year.

ATO'S WORKING FROM HOME SHORTCUT ENDS

To cover the COVID-19 period, the Australian Tax Office set up a "shortcut" method for calculating expenses for working from home.

Between March 1 and June 30, the ATO will allow taxpayers to deduct a flat rate of 80 cents per hour they've worked from home.

From tomorrow, you'll have to revert to the traditional "flat rate" of 52 cents per hour.

"Failing to claim working from home expenses on your tax is akin to flushing money down the toilet. It is your money. Claim it," Kate Browne, a personal finance expert at Finder, said.

MORE SUPER AVAILABLE FOR THOSE WHO NEED IT

To cover those hit financially by the COVID-19 pandemic, the Federal Government allowed some people to access $10,000 of their super in the 19/20 FY and another $10,000 in the 20/21 FY.

From tomorrow, those who already took out $10,000 – and have another $10,000 in their account – may be eligible for a second dip.

"By withdrawing $10,000 now, you will be taking a far greater amount away from your future self," Ms Browne said.

"It is wise to consider all available options for financial assistance before jumping straight into your super."

Also from tomorrow, the age limit for spousal contributions will be raised from 69 to 74.

MINIMUM WAGE IS BOOSTED

From tomorrow, the new minimum wage will be $753.80 a week or $19.84 an hour, up $13 from $740.80 a week ($19.49 an hour).

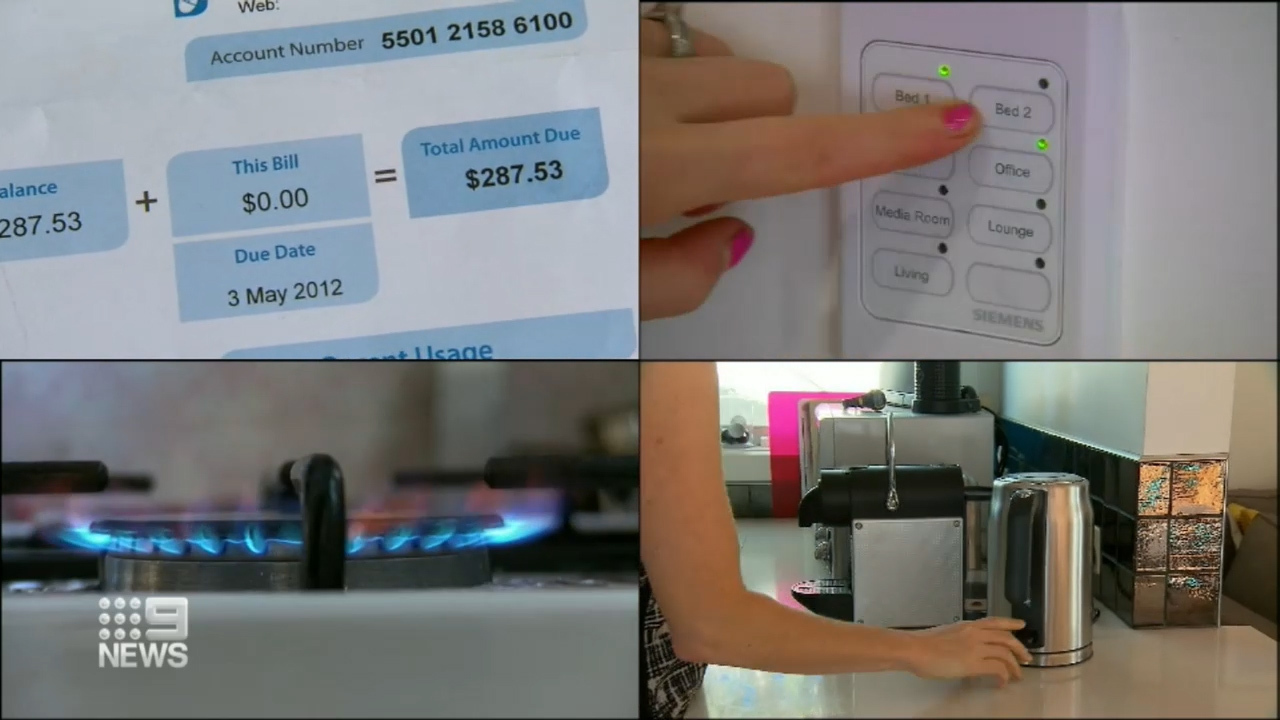

ENERGY BILLS GO UP FOR SOME, DOWN FOR OTHERS

From tomorrow, many Australians can expect to see a rise in their annual energy bills.

New distribution tariffs approved for the 20/21 financial year will see:

- Ausgrid customers pay an extra $13.78 a year

- Endeavour Energy customers pay an extra $21.62 a year

- Essential Energy customers pay an extra $16.61 a year

Ms Browne said the increase in prices is a good incentive for customers to cross-shop their current providers.

"Don't set it and forget it. Whether it is your health insurance, your energy provider or your super," Ms Browne said.

"Monitor your financial products and make sure you are getting the best deal for you."

In NSW, those who hold a Commonwealth Seniors Health Card can apply for energy rebates to keep bills down.

CHILDCARE FEES RETURN

While the government's free childcare program will continue tomorrow, its final days are near: the package is funded to July 12.

That means from July 13 childcare subsidies will return. A week later on July 20, JobKeeper payments for childcare workers will end.

CAR REGISTRATION, LICENCE FEES

Typically car registration and licence fees increase on the first day of each financial year – but due to coronavirus pressures the NSW Government has said there will be a reprieve from the annual increase.

That reprieve isn't national though – from tomorrow Queensland motorists will be slugged with a 1.8 per cent increase.

Fees in the ACT, Victoria, Tasmania and the NT are all frozen.

In South Australia drivers will receive approximately $200 off their registration and insurance premiums.

MORE IN 9NEWS.COM.AU's TAX SERIES:

- EXPLAINED: How to calculate your working at home costs for a maximised tax return

- How to get your tax refund back in less than two weeks

- The top five mistakes people make on their tax returns

- What is the ATO's "shortcut method" and how much can I claim?

- Which workers can claim facemasks, hand sanitiser on tax

For breaking news alerts and livestreams straight to your smartphone sign up to the 9News app and set notifications to on at the App Store or Google Play.

You can also get up-to-date information from the Federal Government's Coronavirus Australia app, available on the App Store, Google Play and the Government's WhatsApp channel.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/2BqacOW

via IFTTT

0 Comments