The government's latest economic lifeline for Australians hurt by COVID-19 restrictions is in full swing, with employers set to receive more than $10,000 over a year.

It's known as the JobMaker Hiring Credit Scheme, and is designed to boost the chances of employment for young people.

But in order to access the payments there are a number of eligibility categories employers and employees need to meet. Here's everything we know about the scheme:

READ MORE: Scott Morrison to outline 'JobMaker' plan for economic recovery

What is the JobMaker Hiring Credit Scheme?

The JobMaker Hiring Credit Scheme is a payment-based program to incentivise employers to hire people aged under 35.

It's designed to try and boost the employment prospects of those that were hurt hardest by COVID-19 restrictions – think part-time retail assistants, bar staff, waiters and more.

READ MORE: Hiring credits, complete asset write-offs for businesses

How much money can you get under the JobMaker Hiring Credit Scheme?

Just to be clear, the payments go the employers. The benefit for employees is that they now have a job.

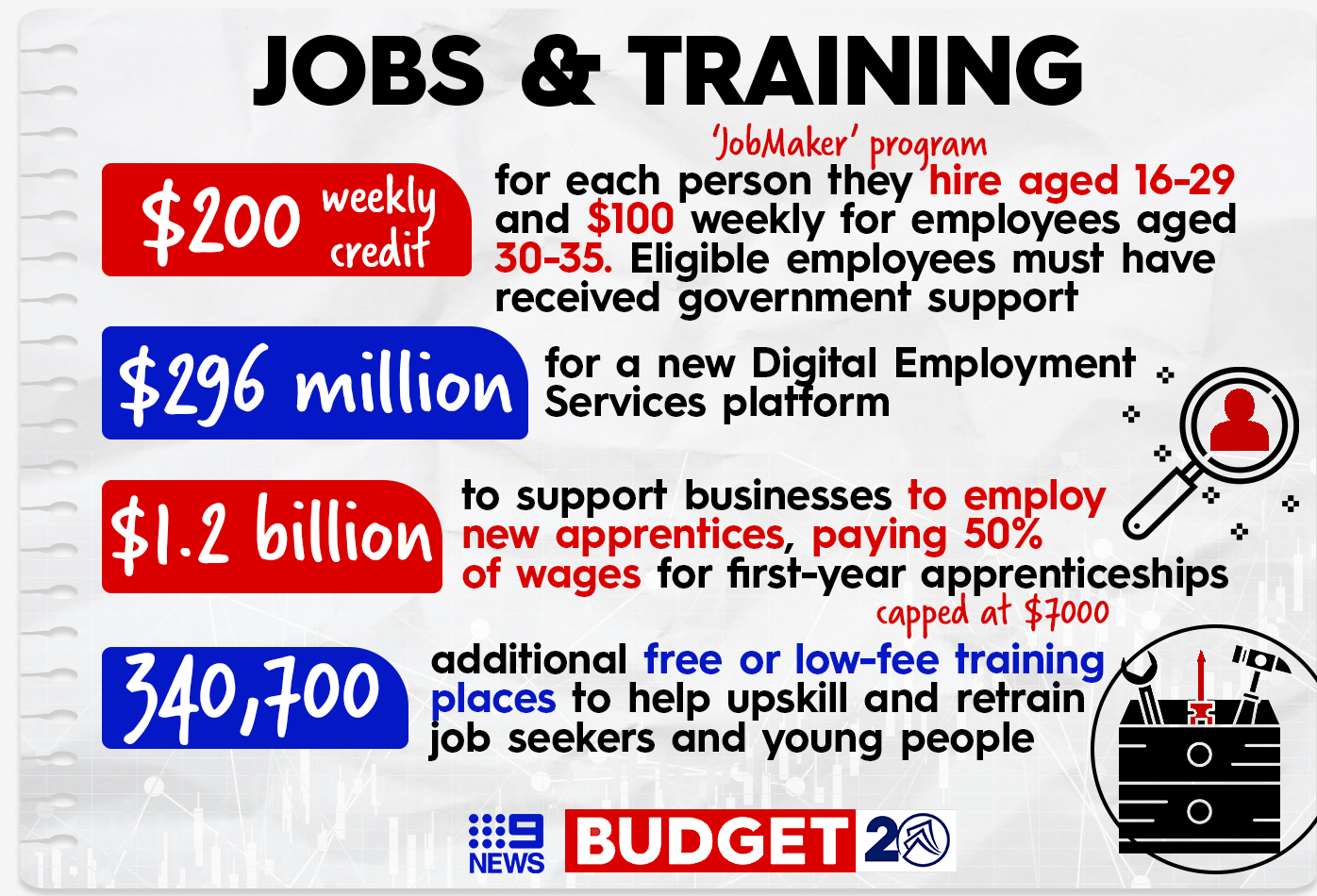

The scheme is split into two tiers: one payment for employees aged 16 to 29, and another for employees aged 30 to 35.

If an eligible employer hires a new employee aged between 16 and 29, they can receive up to $10,400 over a year.

If an eligible employer hires a new employee aged between 30 and 35, they can receive up to $5200 over a year.

READ MORE: Thousands of Aussie JobSeekers left behind as demand for entry-level jobs soars

I see. So can every employer access this scheme?

No.

Employers must be eligible for the scheme, and they must hire the new employees within a specific window.

Employers can only access the scheme if they hire the young people between 7 October 2020 and 6 October 2021.

A full list of employer eligibility can be checked here.

Hang on. If the scheme is for employees hired way back in 2020, why is it starting now?

Essentially employers can start claiming payments in arrears.

The scheme started in October 2020 because it coincided with the Federal Budget.

From February 1, 2021 (yesterday), employers can start claiming payments in arrears every three months for up to 12 months.

READ MORE: Christmas casual work gives hope for thousands on Jobseeker

What about people aged over 35? Doesn't this kill their employment chances further?

I wouldn't say kill, but it certainly blunts employment prospects for older Australians competing for the same jobs as those aged 35 and under (but really for those aged 29 and under).

If an employer had two candidates of equal experience, temperament and skill, it's hard to see why they wouldn't choose a younger one who comes with government incentives.

READ MORE: Job competition declining but Aussies still struggling to find work

I'm an employer interested in claiming this payment. What do I need to do?

First things first I would check if you are eligible.

If you are, you can register for the JobMaker Credit Hiring Scheme via the ATO's online services portal or through your registered tax or BAS agent.

From there it's as simple as nominating your eligible employees and then claiming.

As always, it's best to speak to a professional first to see if the scheme could assist your business.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/39AiT7M

via IFTTT

0 Comments