Move over GameStop, Reddit mania is spreading to the precious metals market.

Silver futures surged as much as 8.5 per cent above $US 29 ($37.90) Sunday evening, touching five-month highs. That follows a six per cent rally last week.

Meanwhile, retail sites warned customers over the weekend they could not meet skyrocketing demand for silver bars and coins. And "#silversqueeze" is trending on Twitter.

READ MORE: Parler's website is back online with a message to 'lovers and haters'

In more recent trading, silver futures were up 6.5 per cent.

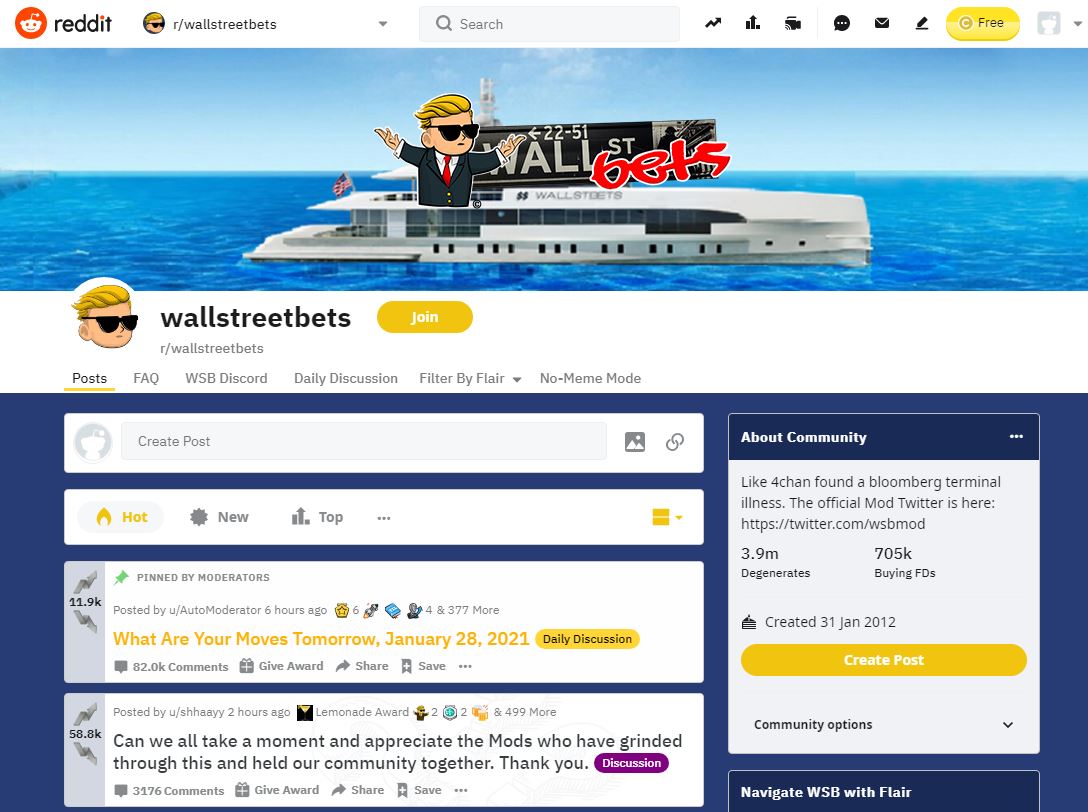

The moves provide another example of the power of a group that has captivated Wall Street and Main Street: WallStreetBets.

The Reddit forum sent GameStop, AMC and other heavily shorted stocks skyrocketing last week, roiling markets and crushing some hedge funds that had bet against those stocks.

Robinhood, the free-trading app, came under fire after restricting trades in GameStop and other stocks.

READ MORE: Former Facebook teen-in-residence takes on gaming challenge

People on WallStreetBets set their sights on silver and the iShares Silver Trust ETF last week, with some suggesting it could be a way to hurt big banks they believe are artificially suppressing prices.

"SLV will destroy the biggest banks, not just some little hedge funds," one WallStreetBets user wrote.

Another claimed JPMorgan Chase has been "suppressing metals for a long time. This should be epic. LOAD UP."

READ MORE: Programmer at peace with losing $300m Bitcoin fortune

https://twitter.com/tyler/status/1355994707046895619https://twitter.com/cameron/status/1355925754798858247Several noted that JPMorgan paid a record $920 million fine last year to settle charges that it engaged in manipulative trades of futures tied to precious metals as well as Treasuries.

The Winklevoss twins, who famously sued Facebook's Mark Zuckerberg and were early backers of Bitcoin, both tweeted support for the push by WallStreetBets into silver.

"The #silversqueeze is a rage against the machine," Tyler Winklevoss tweeted.

"If silver market is proven to be fraudulent, you better believe gold market will be next," Cameron Winklevoss tweeted.

READ MORE: Man who forgot password may lose $300m Bitcoin fortune

Leading retail sites posted warnings over the weekend that they faced heavy demand.

"Due to unprecedented demand on physical silver products, we are unable to accept any additional orders on a large number of products, until global markets open Sunday evening," APMEX, which calls itself the world's largest online retailer of precious metals, wrote in a notice atop its website.

SD Bullion warned that "due to unprecedented silver demand" it would also be unable to accept orders until Sunday evening.

READ MORE: Sony pulls Cyberpunk 2077 from online store

Similar notices were posted by Money Metals and other websites.

"It's not surprising to see the sharp and abrupt uptick in consumer demand overwhelm the physical supply of silver coins held by dealers in the short term," Ryan Fitzmaurice, a commodities strategist at Rabobank, told CNN Business in an email.

However, unlike GameStop and other unloved stocks targeted by WallStreetBets, silver futures have been strong of late. Hedge funds and other institutional investors had been bullish on silver futures and the precious metal was trading near multi-year highs.

"It is a dramatically different market setup," Fitzmaurice said. "I am not sure how well this new Reddit trading strategy will fare in futures markets and especially the notoriously volatile commodity markets."

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/3pOj2de

via IFTTT

0 Comments