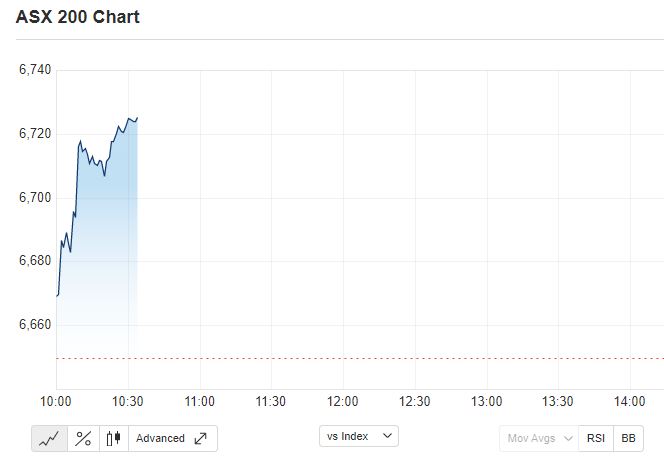

The Australian stock market is rebounding strongly after yesterday's disastrous session that saw more than $50 billion wiped in just two hours.

As of 10.30am AEDT, the benchmark S&P/ASX 200 was up 1.09 per cent or 72 points to 6725 points.

An early leader of the pack is Bluescope Steel, which has picked up almost 7 per cent of value or $1.12 in just 20 minutes.

READ MORE: GameStop stock price crashes as Robinhood app restricts trading

There are few losers at this early stage, with the loss leader currently being mining company IGO, which is down a marginal 1.04 per cent.

Yesterday the market endured its worst single-day session in four months, ending down around $40 billion.

Overnight on Wall Street stocks closed broadly higher, helping the market recoup some of its losses a day after its biggest pullback in nearly three months.

READ MORE: Facebook creator drops to fifth richest person in the world

Investors continued to closely watch the wild swings in GameStop, AMC and several other stocks which have become targets for hordes of online investors who have sent them skyrocketing in recent days, taking on big hedge funds who have bet they will fall.

Several of those stocks fell sharply after Robinhood and other trading platforms restricted trading in them, causing an outcry among customers.

The chaotic trading action is drawing calls in Washington and elsewhere for regulatory action to curb the speculative frenzy.

READ MORE: How Reddit memes are driving stocks up by 1700 per cent

The S&P 500 rose 36.61 points, or 1 per cent, to 3,787.38, lifting the benchmark index out of the red for the year. It had lost 2.6 per cent a day earlier, its biggest drop since October.

The Dow Jones industrial average gained 300.19 points, or 1 per cent, to 30,603.36. The Nasdaq composite added 66.56 points, or 0.5 per cent, to 13,337.16.

The Russel 2000 index of smaller companies slipped 2.09 points, or 0.1 per cent, to 2,106.61.

- Additional reporting by Associated Press

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/2Yq5hWc

via IFTTT

0 Comments