The Australian Tax Office is conducting 14 criminal investigations into fraud of the government's JobKeeper scheme, designed to float employers and employees through the COVID-19 pandemic.

As of October 19 this year, the ATO has permanently stopped around $200 million worth of JobKeeper payments and are currently examining about $100 million worth of claims.

It had clawed back around $120 million worth of payments that had been already paid.

READ MORE: What you need to do to avoid a tax deadline penalty

An ATO spokesperson confirmed to 9News.com.au that a number of claims were being investigated for potential criminal charges.

"We assess all instances of fraudulent behaviour for the consideration of criminal investigations," the spokesperson said.

"As at 13 November 2020, 14 JobKeeper matters are being investigated, referred for prosecution or finalised for the consideration of criminal offences under the Taxation Administration Act 1953.

"There are currently 11 Serious Financial Crime Taskforce operations focused on investigating alleged crimes affecting the ATO-administered COVID-19 stimulus measures – six focusing on early release of super and five focusing on JobKeeper."

READ MORE: ASIC chair to stand aside amid $118k tax advice bill

The tax office said it had already handed out 19 shortfall administrative penalties for those who made false an misleading statements in order to take part in the JobKeeper scheme.

The total value of these penalties is approximately $500,000, and a further 24 matters of alleged JobKeeper fraud are being considered for penalties.

While some have attempted to deliberately take advantage of the scheme, the ATO said most did the right thing and it was always willing to overcome "genuine mistakes".

READ MORE: What to do with your tax cuts: spend or save?

"The ATO will work with employers to avoid and overcome genuine mistakes," the spokesperson said.

"Determinations on penalties are made on the facts and circumstances of each case. We are committed to tackling illegal activity and behaviour of concern to protect honest businesses and the community."

However the ATO said it would not tolerate deliberate attempts to defraud the scheme.

READ MORE: Scammers pretending to be police and ATO prompts fresh warning

"While most businesses and employees are doing the right thing, we have identified concerning and fraudulent behaviour and claims by a small number of organisations and employees," the spokesperson said.

"We will actively pursue these claims. There are penalties for making a false claim and not complying with your obligations."

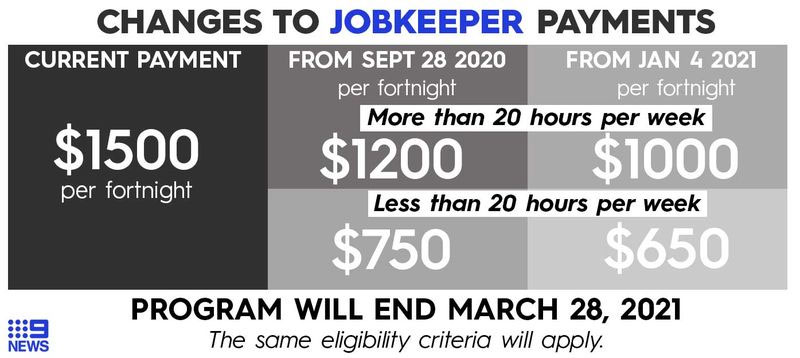

Since the JobKeeper scheme was introduced the ATO has delivered around $69 billion worth of payments.

You can get up-to-date information from the Federal Government's Coronavirus Australia app, available on the App Store, Google Play and the Government's WhatsApp channel.

Beyond Blue's Coronavirus Mental Wellbeing Support Service is a 24/7 service free of charge to all Australians. Visit the site here or call 1800512348

For coronavirus breaking news alerts and livestreams straight to your smartphone sign up to the 9News app and set notifications to on at the App Store or Google Play.

from 9News https://ift.tt/2ItbAUC

via IFTTT

0 Comments