The Australian Tax Office's website has buckled under the weight of thousands of Australians trying to file their tax return, proving that more people than ever are desperate to receive their refund.

Thanks to increased financial pressure from COVID-19, many taxpayers are sweating on using their refund for daily costs.

But rushing through your return – or relying on age-old myths your neighbour's brother's tax agent said 10 years ago – leads many to filling out their return incorrectly.

At best, this will slow down your tax return, and at worst you could face financial penalties for attempting tax fraud.

Here's six common myths and traps the ATO believes will catch out some taxpayers this return season:

READ MORE: How to get your tax refund back in less than two weeks

Lodging as fast as possible does not mean your refund comes back quicker

It's true that most taxpayers who lodge their return online will have their refund (if they are entitled to one) sitting in their bank account in around two weeks.

But lodging your tax today – particularly if you are relying on your employer to provide your income to the tax office – could actually slow your return down.

"Each year the ATO automatically includes information from employers, banks, private health insurers (and this year JobKeeper for employees and JobSeeker amounts) in people's returns," the ATO advises.

"For most people this information is ready by the end of July."

READ MORE: ATO website struggling as thousands attempt to lodge tax returns

Claiming work from home costs? Beware of 'double dipping'

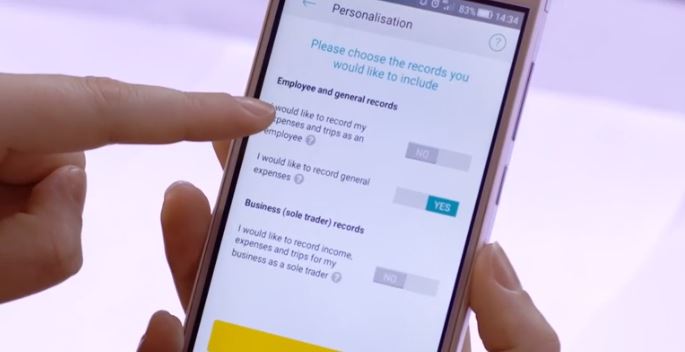

Thousands of Australians will be claiming working from home costs – such as cooling, electricity and internet – for the first time due to COVID-19.

For many, that will involve using the ATO's special "shortcut method" of 80 cents per hour you worked from home, a full guide of which you can find here.

But the ATO has warned that the 80 cent covers everything – including home office equipment – so some taxpayers might find themselves 'double dipping'.

"We are concerned that some taxpayers may either accidentally or deliberately double dip by claiming their working from home expenses using the all-inclusive shortcut method while also claiming for specific items such as laptops or desks," Assistant Commissioner Karen Foat said.

"It's important to remember that if you're claiming under the shortcut method, you cannot claim a separate additional deduction for any expenses you incur as a result of working from home."

READ MORE: How to recoup your costs and bump up your return

Update your bank details – or at least check them

Rushing the clock to get your tax filed on time? Make sure your bank details are up to date.

At the very least, check that your bank account numbers match up with what the ATO has on file.

Bank details don't update automatically, and the ATO only has what you nominated last year.

READ MORE: Tax Office warns attempts to commit JobKeeper fraud will be prosecuted

You cannot claim travel from home to work

This is an age-old trap that has been catching taxpayers out since the dawn of tax.

You cannot (generally – like all things there are exemptions) claim the cost of driving or catching public transport to work.

"If you are working from home due to COVID-19, but need to travel to your regular office sometimes, you still cannot claim the cost of travel from home to work as these are still private expenses," Ms Foat warns.

"Even though you are working from home, your home is still a private residence – it is not a 'place of business'."

READ MORE: The top five mistakes people make on their tax returns

You need proof of your expenses – if they cost below $300

There's a recurring mindset among some taxpayers that because work-related expenses below $300 are refunded instantly, everyone can claim $299 without raising red flags.

That's simply untrue, the ATO says, and you will still need to be able to prove that it's related to earning your income.

"We often see people claiming a deduction despite not purchasing anything. When we question them, we often find it's because they thought everyone is entitled to claim $300," Ms Foat advises.

"While you don't need receipts for claims of expenses up to $300 but you must have actually spent the money and be able to show us how you worked out your claim."

READ MORE: What is the ATO's "shortcut method" and how much can I claim?

Your work expenses need to be directly related to your work

It sounds straightforward, but the liberties of what is needed for work are stretched by some taxpayers who will attempt to claim daily living costs as part of their income.

"For example, people who are working from home can't claim these items and so a high work from home claim together with a large claim for protective items may trigger a red flag and slow down your return," Ms Foat said.

"People also cannot claim for the costs of setting their children up for home schooling. These costs are private expenses."

READ MORE: Which workers can claim facemasks, hand sanitiser on tax

MORE IN 9NEWS.COM.AU's TAX SERIES:

- EXPLAINED: How to calculate your working at home costs for a maximised tax return

- How to get your tax refund back in less than two weeks

- The top five mistakes people make on their tax returns

- What is the ATO's "shortcut method" and how much can I claim?

- Which workers can claim facemasks, hand sanitiser on tax

For breaking news alerts and livestreams straight to your smartphone sign up to the 9News app and set notifications to on at the App Store or Google Play.

You can also get up-to-date information from the Federal Government's Coronavirus Australia app, available on the App Store, Google Play and the Government's WhatsApp channel.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/3imC3R4

via IFTTT

0 Comments